10 Simple Techniques For Home Owners Insurance In Toccoa Ga

Wiki Article

The Buzz on Affordable Care Act Aca In Toccoa Ga

Table of ContentsGetting The Affordable Care Act Aca In Toccoa Ga To WorkIndicators on Affordable Care Act Aca In Toccoa Ga You Need To KnowThe Final Expense In Toccoa Ga PDFsLittle Known Questions About Life Insurance In Toccoa Ga.

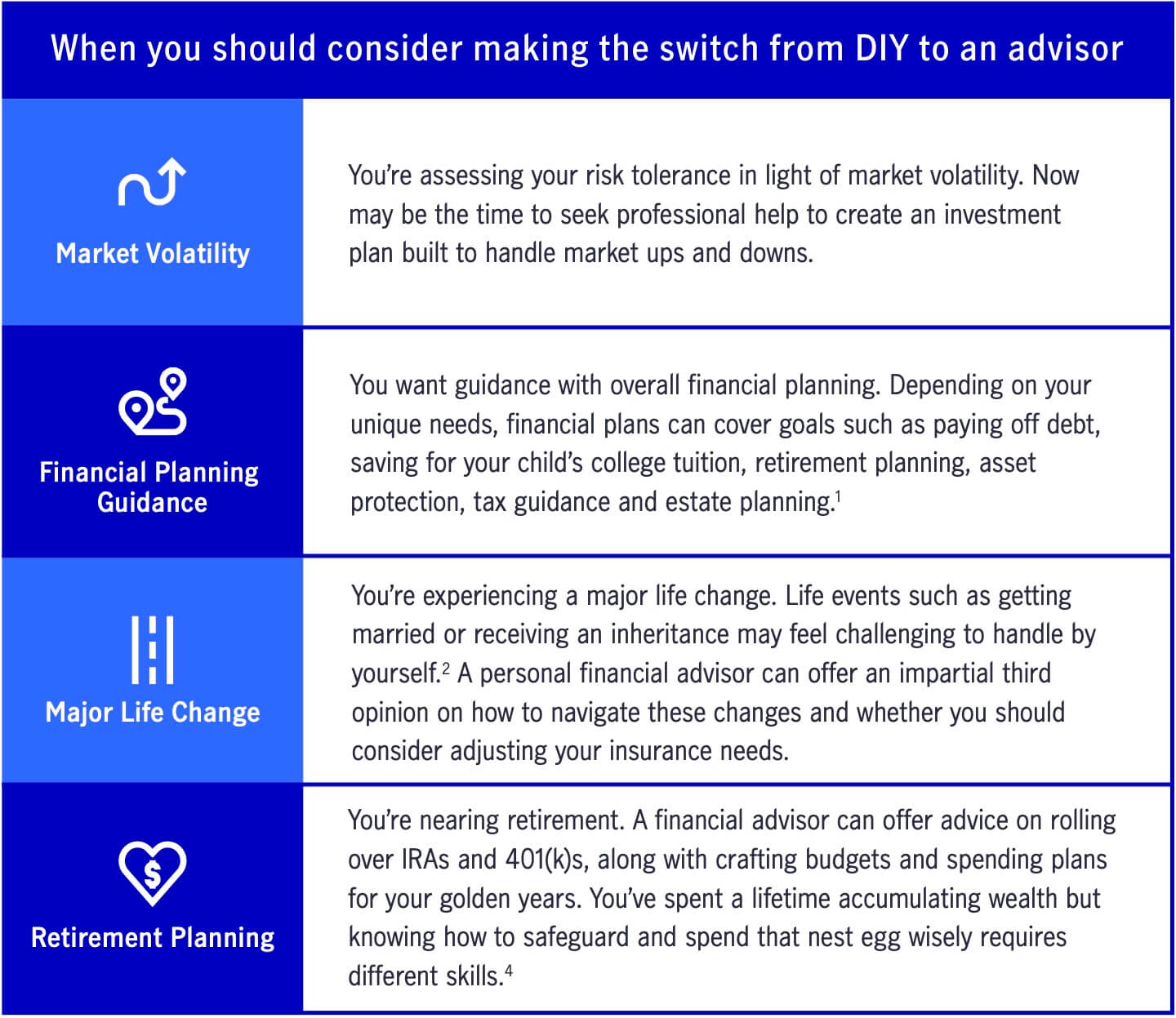

A financial expert can additionally aid you decide how finest to attain objectives like saving for your kid's college education and learning or repaying your debt. Monetary advisors are not as well-versed in tax obligation regulation as an accounting professional might be, they can offer some support in the tax planning process.Some financial advisors provide estate planning solutions to their clients. They may be learnt estate preparation, or they might wish to deal with your estate attorney to address questions regarding life insurance policy, counts on and what should be finished with your investments after you die. It's important for economic consultants to remain up to date with the market, financial problems and consultatory ideal practices.

To offer investment items, advisors must pass the relevant Financial Market Regulatory Authority-administered tests such as the SIE or Series 6 exams to obtain their accreditation. Advisors that want to sell annuities or other insurance policy items have to have a state insurance policy license in the state in which they plan to offer them.

The Ultimate Guide To Final Expense In Toccoa Ga

Let's say you have $5 million in assets to handle. You work with an advisor who charges you 0. 50% of AUM per year to help you. This indicates that the consultant will certainly receive $25,000 a year in costs for handling your financial investments. Due to the typical charge structure, many consultants will certainly not work with clients that have under $1 million in possessions to be managed.Investors with smaller portfolios could look for a financial expert who bills a per hour cost as opposed to a percent of AUM. Per hour costs for advisors generally run in between $200 and $400 an hour. The even more complicated your monetary scenario is, the even more time your expert will certainly have to commit to managing your properties, making it much more expensive.

Advisors are knowledgeable experts who can aid you develop a prepare for financial success and implement it. You could also consider reaching out to a consultant if your individual monetary situations have just recently ended up being more complicated. This could indicate getting a house, marrying, having children or getting a large inheritance.

Some Known Facts About Life Insurance In Toccoa Ga.

Before you satisfy with the consultant for an initial consultation, consider what services are most essential to you. Older adults might need assist with retired life preparation, while younger grownups (Medicare/ Medicaid in Toccoa, GA) might be searching for the very best method to invest an inheritance or beginning a business. You'll intend to seek out an expert who has experience with the solutions you want.What business were you in before you obtained right into financial suggesting? Will I be working with you directly or with an associate expert? You might additionally desire to look at some example financial plans from the expert.

If all the samples you're supplied are the same or comparable, it may be a sign that visit this website this consultant does not correctly tailor their advice for each and every customer. There are 3 major sorts of monetary suggesting specialists: Qualified Financial Coordinator experts, Chartered Financial Experts and Personal Financial Specialists - https://www.startus.cc/company/thomas-insurance-advisors. The Certified Financial Organizer professional (CFP expert) accreditation suggests that an expert has actually fulfilled an expert and honest criterion established by the CFP Board

The Ultimate Guide To Health Insurance In Toccoa Ga

When picking an economic consultant, consider a person with a specialist credential like a CFP or CFA - https://www.brownbook.net/business/52148824/thomas-insurance-advisors/. You may likewise take into consideration an expert that has experience in the services that are essential to youThese advisors are typically riddled with conflicts of rate of interest they're much more salespeople than advisors. That's why it's crucial that you have an expert that functions only in your benefit. If you're seeking an expert that can really give actual value to you, it is essential to investigate a number of prospective choices, not merely choose the given name that markets to you.

Presently, numerous consultants need to act in your "ideal interest," however what that involves can be practically unenforceable, other than in the most outright situations. You'll need to locate a real fiduciary. "The initial test for a great monetary expert is if they are benefiting you, as your supporter," claims Ed Slott, certified public accountant and founder of "That's what a fiduciary is, but every person says that, so you'll need other signs than the expert's say-so or also their credentials." Slott suggests that customers want to see whether advisors invest in their recurring education and learning around tax obligation preparation for retirement cost savings such as 401(k) and individual retirement account accounts.

"They should verify it to you by showing they have taken serious recurring training in retirement tax and estate planning," he says. "You ought to not spend with any kind of advisor who does not spend in their education.

Report this wiki page